В книге есть 25 глав, в которой объединяют проблемы исскуства, жизни и человека . Возможно, это далеко не лучшая книга и она вас не заинтересует, но о ней стоит знать, вдруг захотите узнать больше. Автор написал эту книгу чтобы помочь людям ,что бы он мог познать себя как личность, а так же прочитать тем кому станет интересно

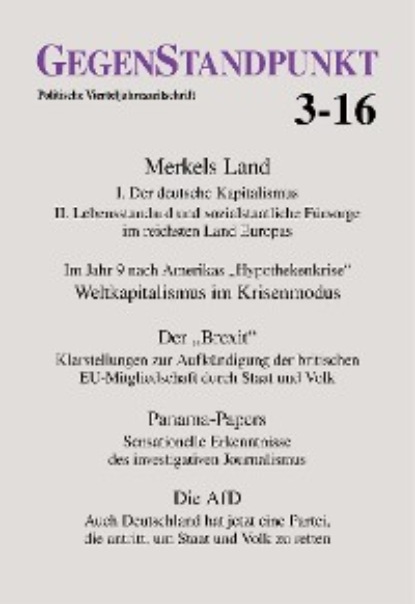

Markel's Land. 3- 16 In a year before Germany introduced the "Dogma" of her nation's virtues, the chancellor of the Federal Republic of Germany brought a criterion for the strength of her country: that the face value describing the country she governs should also be "her land" in the moral sense - i.e. flawless in every respect. This applies to dealing with refugee influxes. All supporters of the republic are proud of its new openness towards the world and celebrate efforts to accommodate refugees: "We will do this!" All criticism of Merkel's run is based around the question whether this project does not overburden the integration capacity of land and its people, or even where the crossing point lies between the victims of economics and politicians is. One thing they agree on: Decision-making on the marginal part of refugee management determines what to do with this republic. It should be the peculiarity of that land?

9 years after the "Mortgage Crisis" in America, World Capitalism in Crisis. Major global powers give their credit industry enough money at zero charge, but nothing more to earn. Their central banks virtually refinance their banks' financial needs for free, thus lowering the general interest level into the low percentage area. They buy up public and, by now, even commercial bonds in numbers whose return falls to zero. Also, state accounts sell back their loans at minimal interest rates and even with a premium on the buyer's expense, which presses down the yield. These states not only disappoint their savers, they drain the fundamental banking business, the loan-lending process to such an extent that it is ridiculous, and the loan lending to such a degree that it is better. They make the investment bank as a source of income obsolete. Quantity-wise and exceptional, too, but the money provided by their central bank goes beyond quantity. They not only strip it of qualified ratemaking, they cause currency that runs independently from credit.

«Merkels Lands» by various authors.

This year, the German Chancellor pushed a new standard for the quality of her country: that the land she rules over should also be viewed as «her land» in a moral sense; that it is impeccable, without fault, in every respect, when dealing with large groups of refugees. All supporters of the republic are proud of her new openness regarding the world and take pleasure in making efforts to accommodate the welcomed refugees: «We can do it!». The criticism of this approach centres on the question whether this project might overwhelm the integration direction of both the country and the residents, or even the point where the betrayal of the people by the «good people» in politics and society will become obvious. One thing stands out: the peripheral issue of the digestion of the refugee flow is supposed to decide what to make of this republic. This is what should be characteristic of this country?

Nine years after America’s «mortgage crisis», worldwide capitalism is operating with a crisis mode. The dominant global economic powers give their lending business enough money at zero tariff to earn nothing – and nothing more to earn either. Their central banks practically refinance every financial need their banking world has at virtually no cost, causing a reduction in the common interest rate to the low per mil area. They, with the power of money, create money and make commercial debt instruments, to the extent that their yield goes to zero. Meanwhile, state financial houses sell their loans at minimal rates and even with a charge to the buyers who reduce the yield. These states not only disappoint their savers, they also critically undermine the fundamental bank business, making lending at lower or lending at higher rates into an absurdity, rendering the money investments in one department in the stock market invaluably obsolete. Their monetary support isn’t just quantitatively unusually abundant; they also disqualify the quality of a loan business by supporting solvency.

#зарубежная публицистика